State Health Plan – Pharmacy Copay Assistance Cards and Your Deductible

(Members Enrolled in the 70/30 & 80/20 Plans)

Prescription copay cards are offered by drug manufacturers to reduce members’ out-of-pocket costs for prescription medications. The State Health Plan (Plan) does not offer nor manage copay cards, but the Plan does support the usage of these cards or coupons to assist members with the high cost of medication

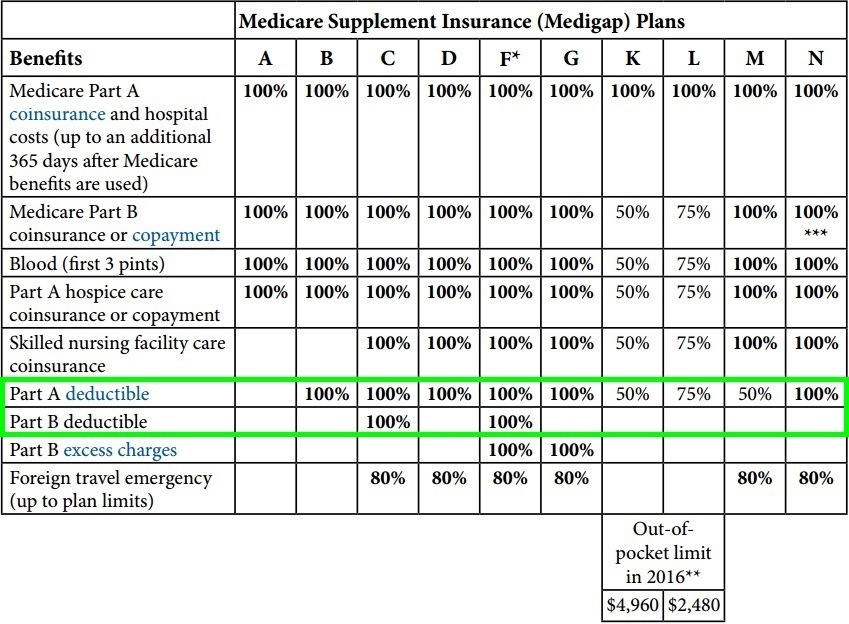

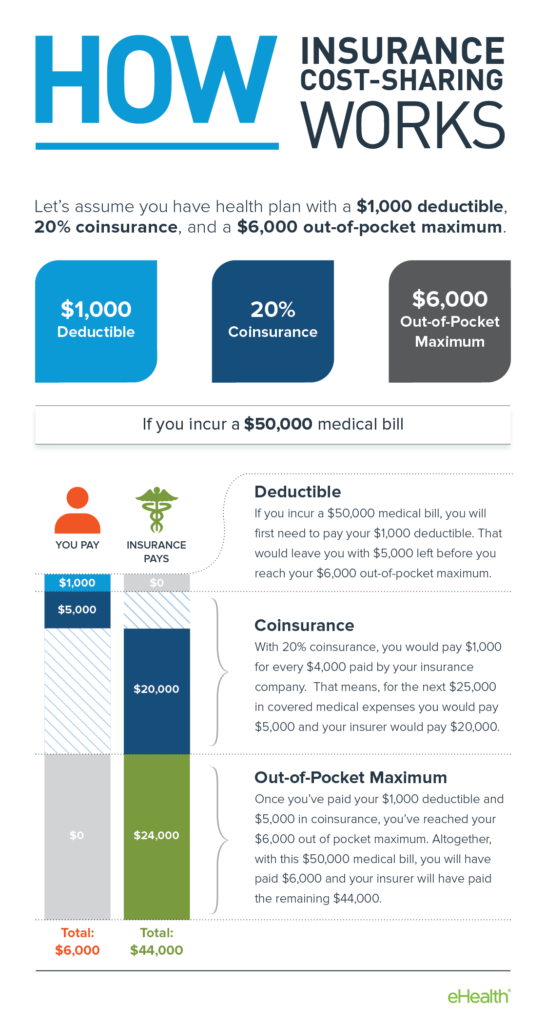

Deductibles can work differently depending on your health insurance plan. Generally, all payments you make for covered healthcare services will count toward your annual deductible, unless the payment is considered a copay. Copays are a fixed amount you pay to see your doctor or a specialist. Pertaining to health insurance, what does 'Copay with deductible' mean, in contrast to 'Copay after deductible'? I get 'Copay after deductible' - you must pay for the service fully out of pocket until your deductible is met, after which you must only pay the copay amount and the insurance pays for the rest.

Important Reminder for Members: Only the amount you actually pay for your prescriptions will be applied toward your deductible or out-of-pocket maximum, when using a third party or manufacturer copay card or coupon. For example, if your copay is $2,000 and the copay card covers $1,995, you pay $5 and the $5 paid would be applied to your deductible or out-of-pocket maximum. In many circumstances the copay card pays for all of the costs, resulting in no cost to you. In this situation nothing would apply to your deductible or out-of-pocket maximum because you did not pay anything out-of-pocket.

A copay is a flat fee you pay whenever you receive certain health care services or get prescription drugs. Copays may apply before and after you hit your deductible. A copay is different from coinsurance, which only applies after reaching your deductible and is the percentage of your final bill that you pay.

Overall, your deductible and out-of-pocket maximum include the amounts you actually pay out of pocket. Using a copay card lowers your out-of-pocket expenses, assisting with the expense of the medication, but does not impact your deductible or out-of-pocket maximum.

Deductible Then Copay Card

This information can be viewed on the State Health Plan’s website under Employee Benefits or Retiree Benefits, whichever is applicable. Once there, select your plan then Pharmacy Benefits for that plan. From Pharmacy Benefits:

Health Insurance Copays Deductibles

- Select Pharmacy Cost-Saving Programs

- THEN scroll down the page to find Copay Assistance Cards and How They Affect Your Deductible.